Civil nuclear power in 2025: a fragmented Europe in search of energy sovereignty

Published November 3, 2025

- Energy & Utilities

- Sustainability

Key findings

- On the eve of the 6th edition of the World Nuclear Exhibition (WNE), which will be held from November 4 to 6 in Paris, Wavestone wanted to provide an overview of the civil nuclear industry in Europe in 2025, in light of the challenges posed by the current climate and energy crisis.

- In 2025, 23 European countries are investing in civil nuclear energy. While the debate remains active in some regions, nuclear is now widely seen as a solid pillar of the future electricity mix.

- Nuclear energy is emerging as a vital lever of sovereignty, particularly in Eastern Europe. Following Russia’s invasion of Ukraine, the urgency to stabilize energy prices has intensified.

- Small Modular Reactors (SMRs) are becoming a shared strategic lever.

Between 2006 and 2023, European nuclear production fell by 32%, representing less than 25% of the EU’s electricity generation in 2024. Yet 2025 marks a turning point. In the wake of Russia’s invasion of Ukraine, the pursuit of energy sovereignty has gone global. Many countries, driven by the need to stabilize prices, are reconsidering nuclear as a strategic pillar of their electricity mix.

This shift is already visible worldwide: 417 nuclear reactors are currently operational across 31 countries, with 62 more under construction. Nuclear accounts for roughly 9% of global electricity production and remains, after hydropower, the second-largest source of low-carbon electricity. Europe hosts around 100 active reactors but faces a fragmented landscape:

- Western Europe: a leader in civil nuclear power and a driving force for the energy transition

- Central Europe: a revival underway, balancing energy transition and regulatory reform

- Northern Europe: nuclear innovation serving decarbonization

- Eastern Europe: civil nuclear power as a vital lever of sovereignty & security

- The Iberian Peninsula and Austria: the enduring skeptics

Behind the investment announcements—estimated by the European Commission at over €240 billion by 2050 to maintain and expand nuclear capacity—a key question emerges: could Small Modular Reactors fundamentally redefine the role of nuclear in Europe’s energy mix?

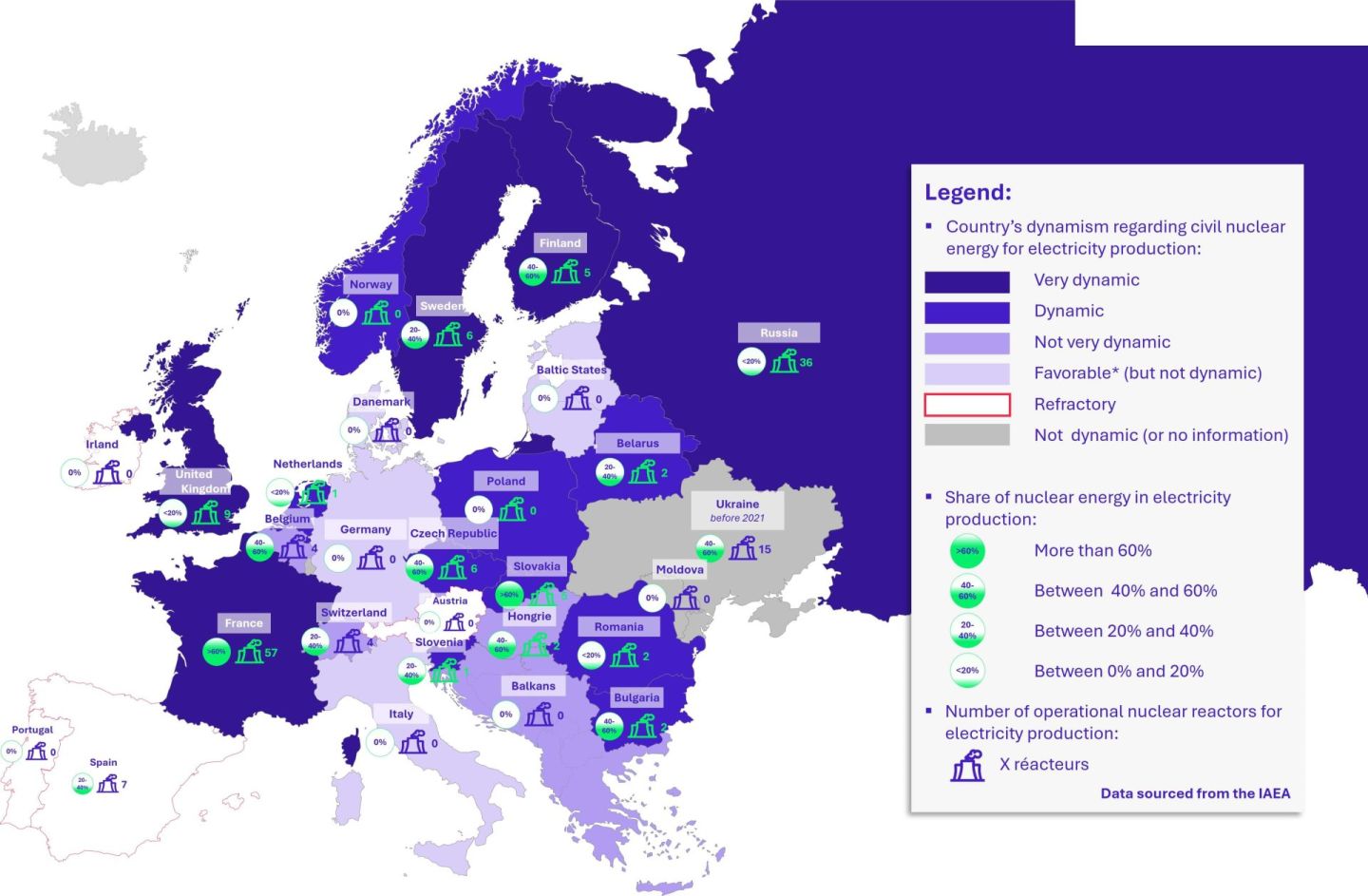

The dynamism of European countries in the field of civil nuclear power

Western Europe: a leader in civil nuclear power and a driving force for the energy transition

When it comes to nuclear energy in Europe, France stands out as an undisputed leader. The United Kingdom, for its part, operates the fourth-largest active nuclear fleet on the continent. Belgium, finally, after a marked policy shift in 2025, appears to be embracing a more pragmatic energy strategy.

France is the undisputed leader in European nuclear energy. With 57 reactors across 18 sites and an installed capacity of 63 GWe, it operates the continent’s largest nuclear fleet. This strength is built on an integrated industry led by global players such as EDF, Framatome, and Orano, which export expertise to over 30 countries and generate nearly €6 billion in annual economic impact. The sector supports around 220,000 direct and indirect jobs and relies on a cutting-edge research ecosystem, notably the CEA. A rigorous safety framework, recognized internationally, further reinforces France’s role as a cornerstone of European nuclear energy and a key player in the energy transition.

With 9 reactors and a capacity of 5.8 GWe, the UK has the fourth-largest active nuclear fleet in Europe. However, due to its strong momentum, it is often considered the second-largest nuclear power in the region. This status stems from the government’s clear commitment to strengthening nuclear’s role in its energy transition strategy.

Major projects reflect this renewed interest. The most advanced is the construction of two EPR reactors at Hinkley Point. A second similar project has received government approval, with a £14.2 billion investment decision for two EPRs at Sizewell. A third project is under consideration at Wylfa, west of Manchester, where a high-capacity plant could be built. These initiatives aim to offset declining nuclear output due to aging plant closures. SMR projects are also being explored to secure energy targets.

Regulatory reforms are underway to streamline procedures for new plant construction and accelerate deployment. This momentum makes the UK a strategic market for major industry players, notably EDF, which ranks it among its G4 (Group of four European countries—France, the United Kingdom, Italy, and Belgium—historically linked to EDF and sharing common challenges around civil nuclear power, particularly in terms of industrial cooperation and energy policies.). priority countries. EDF currently operates five UK nuclear plants through its subsidiary EDF Energy.

After 22 years of anti-nuclear policy, Belgium made a major shift by repealing, on May 15, 2025, the 2003 law mandating the closure of its seven reactors by the end of 2025 and banning new construction.

This reversal is driven by sustained energy price increases, exacerbated by the war in Ukraine, and rising electricity demand. Belgium’s nuclear fleet originally produced 5.8 GWe, or 41% of national electricity. However, several reactors were shut down between 2022 and 2023, leaving only five operational.

At the end of 2023, an agreement between the Belgian government and ENGIE (via Electrabel) extended two reactors until 2035, totaling 2 GWe. The government aims for an 8 GWe nuclear fleet, considering further extensions and new projects, including SMRs and next-generation technologies.

ENGIE plans a gradual nuclear exit, opening the door for new players in operations, maintenance, and future development. Belgium is adopting a pragmatic energy strategy to secure supply, control costs, reduce emissions, and foster an innovative nuclear sector.

Central Europe: a time of renewal, between energy transition and regulatory reform

While Germany officially phased out nuclear energy in 2023, the debate has recently resurfaced under a more supportive government, opening the door to a potential policy reversal in the medium to long term. Italy, after a decade without civilian nuclear power, is cautiously re-engaging in the sector, backed by strong political will. Denmark, for its part, took a symbolic step forward after forty years of prohibition by passing legislation allowing exploratory studies on civilian nuclear energy.

Since the final shutdown of its last reactors in April 2023, Germany has officially withdrawn from nuclear energy. This decision is part of a long-standing anti-nuclear policy, reinforced by the gradual dismantling of existing infrastructure.

However, the nuclear debate appears to have been reignited under the recent leadership of a more favorable executive. In February 2025, the government proposed a moratorium to suspend the dismantling of the last three reactors. This initiative comes as 67% of the German population now supports nuclear energy, with some associations even advocating for the reactivation of at least six reactors. The issue remains divisive within the government, making the future of the sector uncertain.

Technically, restarting existing reactors would require significant investment, time, and the reassembly of dispersed expertise. In this context, building new reactors seems a more realistic option. Germany is also exploring alternatives such as SMRs, considered more flexible and better suited to current challenges.

Moreover, the country remains active in strategic areas of civil nuclear energy—fuel production, waste reprocessing, and nuclear fusion—allowing it to retain key capabilities that could be leveraged in a future policy shift.

In summary, a return to nuclear energy in Germany remains possible in the medium to long term, but will depend on resolving technical and legal constraints, as well as evolving political dynamics.

With no nuclear reactors in operation and over a decade of civil nuclear abandonment, Italy is initiating a strategic shift. In early 2025, the government unveiled an ambitious recovery plan to reintegrate nuclear energy into the national electricity mix.

If approved by Parliament, a favorable legislative framework could be established by the end of 2025. The goal is to generate nuclear electricity by 2030, targeting a share of 11% to 22% of the national mix.

However, public opinion remains influenced by the 2011 referendum, in which 94% of voters opposed nuclear energy. To address this, the Italian government is promoting a “Made in Italy” nuclear approach, led by domestic companies such as Ansaldo Nucleare, Federacciai, and Edison.

SMRs are central to the strategy. They offer a more flexible and faster solution, although Italy lags technologically behind its neighbors. These compact reactors could effectively meet growing energy demand and carbon neutrality goals, while mitigating political risks associated with large centralized projects.

Italy is thus cautiously re-entering the nuclear sector, backed by strong political will. The success of this revival will depend on bridging the technological gap and securing legislative consensus in a still-sensitive context.

In 2025, after forty years of prohibition, Denmark took a symbolic step by passing a law authorizing exploratory studies on civil nuclear energy. The aim is to assess the technological, environmental, and societal impacts of a potential return to nuclear.

This initiative does not signal an immediate relaunch but reflects a political willingness to reconsider nuclear’s role amid energy transition and geopolitical tensions. Only next-generation technologies, particularly SMRs, are being considered—excluding conventional nuclear.

Denmark’s energy mix remains dominated by wind, solar, and biomass, which together account for nearly 90% of electricity production. However, their intermittency is prompting the government to seek low-carbon backup solutions. SMRs, with their flexibility and safety, appear to be a credible option.

Denmark is entering a structured reflection phase, without concrete commitments, but potentially paving the way for a shift in its energy strategy.

Northern Europe: nuclear innovation serving decarbonization

While Norway is cautiously beginning to integrate nuclear power into its energy mix, Sweden and Finland are taking more decisive steps to expand their nuclear capabilities.

Long reluctant to include nuclear in its energy mix, Norway is taking a major turn in 2025. Faced with rising electricity demand—driven by industrial decarbonization and significant electrification across sectors—the country is reaching a physical limit. Hydropower currently accounts for over 90% of electricity production, but its potential is nearly saturated. Climate change, marked by recent droughts, is further reducing water resource availability and intensifying this constraint.

In response, the Norwegian government is exploring new solutions to ensure low-carbon and sovereign electricity supply. In May 2024, the Ministry of Energy launched a public consultation to assess the integration of nuclear into the national energy mix. The study, expected to conclude in 2026, will examine safety, waste management, and energy sovereignty issues.

Initial findings, which are relatively favorable, are generating growing interest in SMRs (Small Modular Reactors). Several pilot projects are already under consideration, notably in the municipalities of Aure and Heim, where Norsk Kjernekraft plans to build two SMRs with a total capacity of 1.5 GW. These compact and more flexible reactors, unlike conventional ones that are too costly and time-consuming for a country without an established nuclear industry, offer Norway a rapid, scalable solution suited to its industrial capabilities.

While Norway cautiously begins integrating nuclear into its energy mix, its neighbors Sweden and Finland are reinforcing their capacities.

In 2023, Sweden took a strategic turn by amending its Environmental Law to remove two long-standing restrictions: the cap of ten reactors nationwide and the ban on building on new sites. This reform comes amid significant energy tensions. Although Sweden’s electricity mix is already among the most decarbonized in Europe, the country must double its electricity production by 2045 to meet the growing needs of its energy-intensive industries and climate ambitions. Nuclear is positioned as a cornerstone of this strategy. The government plans to commission two high-capacity reactors by 2035, and ten by 2045.

In parallel, a financial model for these new reactors is under review. A bill introduced in March 2025 proposes repayable public loans and Contracts for Difference (CfD) to secure investments. Final financing terms are expected by autumn 2025.

SMRs also play a central role in this strategy. Faster to build and better suited to local needs, they are being considered to strengthen supply in remote regions. Advanced projects are underway in Ringhals, with other initiatives emerging across the country.

Sweden also stands out for its leadership in nuclear waste storage, with reference infrastructure in Europe. Backed by industrial expertise and a suitable regulatory framework, Sweden has all the tools to successfully manage its nuclear revival.

Finland, for its part, is seen as a pioneer in Europe, having commissioned the Olkiluoto 3 EPR reactor in April 2023—the most powerful in Europe. Despite a thirteen-year delay and major cost overruns, it now produces 15% of the country’s electricity.

Following Olkiluoto 3’s commissioning, the Finnish government is already planning a new high-capacity nuclear plant, anticipating a sharp rise in electricity demand—potentially doubling by 2050.

Where Finland truly innovates is in its use of SMRs. While SMRs are increasingly used for electricity generation, Finland is integrating them into its urban heating decarbonization strategy. The LDR-50 reactors, developed by national startup Steady Energy, are designed to provide low-temperature heat and replace fossil-fuel boilers. With commissioning planned for 2030, these projects mark a shift in how nuclear is conceptualized.

Like Sweden, Finland is among Europe’s leaders in nuclear waste management and storage. Its choice of deep geological storage, supported by a long-term plan and strong public support, offers a credible model. These countries demonstrate that sustainable nuclear management is achievable.

Eastern Europe: civil nuclear power as a vital lever of sovereignty & security

In 2025, Poland stands among the few European countries developing a civilian nuclear program from scratch, driven by broad public support. Romania and the Czech Republic, for their part, must adapt their inherited nuclear frameworks to address emerging challenges.

In 2025, Poland is one of the few European countries to be developing a civil nuclear program ex nihilo. This shift, supported by a highly favorable public opinion (over 90% approval), is driven by a dual urgency.

On the one hand, the country must reduce its emissions to meet its climate commitments. Poland currently relies on coal for 66% of its electricity production. On the other hand, it must secure its energy sovereignty in an unstable geopolitical environment. This ambition was notably reinforced after the invasion of Ukraine in 2022, which marked a sharp break in energy relations between Russia and Poland. In 2021, 81% of Poland’s imported gas came from Russia, mainly via the Yamal pipeline, which crosses Belarus and Poland. This supply was completely cut off in 2022, prompting the country to rethink its energy model.

Poland aims to install between 6 and 9 GW of nuclear capacity by 2043, as part of the PEP40 plan. By then, nuclear power should account for around 16% of the country’s national electricity production. The flagship project of this initiative is the construction of Poland’s first commercial nuclear power plant. This project represents the largest energy investment in Polish history, with over 28% financed by public subsidies and state guarantees covering 70% of the remaining costs.

In parallel, Poland is positioning itself as a key player in modular nuclear power with a program of 24 Small Modular Reactors (SMRs) spread across six industrial sites. These compact BWRX-300 reactors, developed with a serial construction logic, are expected to be operational by 2030 and provide low-carbon, local energy for industry, urban heating, and remote areas. The project has entered an advanced preparation phase with finalized governance and the establishment of a construction management structure. However, it is worth noting that no SMRs are currently in operation in Europe. Poland nonetheless has all the assets to be at the forefront of deploying this new generation of reactors.

Poland’s strategic choices reflect a clear ambition: to make nuclear power a pillar of its energy sovereignty and, ultimately, of its strategic power, with the country even expressing interest in NATO’s shared nuclear program.

Unlike Poland, which is building its nuclear program from scratch, Romania and the Czech Republic represent another path: countries that must transform inherited models to address new challenges.

Romania currently has only one nuclear power plant, Cernavodă, built with Canadian CANDU technology. It operates two reactors that provide around 20% of the country’s electricity production. Faced with growing demand and the need to reduce reliance on fossil fuels, Romania aims to increase its nuclear capacity to 2.6 GW by 2031, with the goal of nuclear accounting for 66% of its low-carbon production. The construction of two additional reactors on the same site is central to this strategy. Started in the 1980s and later halted, these partially built reactors will be completed by leveraging existing infrastructure, reducing costs and accelerating timelines.

Beyond expanding its existing fleet, Romania is positioning itself as a nuclear innovation player. It hosts the ALFRED project, a lead-cooled advanced reactor demonstrator developed with Italy and Belgium. This fourth-generation reactor offers enhanced accident resistance, passive safety systems, and the ability to recycle spent fuel, thereby reducing long-lived radioactive waste. It could also provide industrial heat and contribute to hydrogen production, paving the way for more diversified energy uses.

In parallel, Romania is exploring Small Modular Reactors (SMRs) through the NuScale project as a diversification lever. Supported by the United States, this initiative could position the country among the first in Europe to deploy this new generation of reactors.

The Czech Republic follows a similar logic, focused on transforming a fleet inherited from the Soviet era. Its two plants, Dukovany and Temelin, operate six reactors that provide around 35% of national electricity production. Historically based on Russian technologies, this fleet is now entering a strategic renewal phase, driven by energy, climate, and geopolitical concerns.

Faced with aging infrastructure, Prague has launched a new reactor project at Dukovany, scheduled for 2036. This decision marks a deliberate break with Rosatom, the Russian state-owned nuclear company, and reflects a desire to diversify partnerships with the United States and South Korea. This approach signals a strategy of energy disengagement from Russia in a tense geopolitical context.

Amid growing geopolitical instability and historical dependence on fossil or Russian energy, several Eastern European countries are making nuclear power a cornerstone of their energy and security strategies. In contrast, Belarus embodies the opposite logic. Its two Russian-designed reactors, commissioned in 2020 and 2023, reinforce its alignment with Moscow. Their location less than 50 kilometers from the Lithuanian capital has sparked regional tensions and underscores that, in this part of Europe, nuclear power remains inseparable from geopolitical power dynamics.

The Iberian Peninsula and Austria: the enduring skeptics

While Spain continues to debate the pace of its nuclear phase-out, Portugal pursues a fully renewable energy strategy, while also seeking to secure its energy supply. Austria, meanwhile, has maintained a strong political and societal consensus against civilian nuclear power since 1978, opting instead to invest in renewable energy.

The Iberian Peninsula illustrates two distinct approaches to civil nuclear power, while sharing common energy challenges.

Spain, engaged since 2019 in a nuclear phase-out plan (PNIEC), maintains its goal of a complete shutdown by 2035. However, faced with the intermittency of renewable energy and the lack of sufficient storage solutions, the April 2025 blackout reignited debate. Increasingly, voices are calling to extend the lifespan of existing plants—not to reverse the phase-out, but to adjust its timeline.

Portugal, for its part, has no nuclear projects and relies on a predominantly renewable electricity mix (71%). The decline in fossil fuel imports and the decommissioning of its inactive research reactor since 2019 confirm this direction. Nevertheless, the country is exploring grid management solutions, notably through interconnections with France, to enhance the stability of its electricity system.

Thus, while Spain debates the pace of its nuclear exit, Portugal continues its 100% renewable strategy, while seeking to secure its supply. Both countries share the same concern: ensuring grid reliability during the energy transition without resorting to nuclear power.

Austria holds a unique position in the European nuclear landscape. Host country of the International Atomic Energy Agency (IAEA) headquarters in Vienna, it plays a central role in global nuclear governance while strictly prohibiting the use of nuclear energy on its territory. This stance dates back to 1978, when the Austrian population voted in a referendum against commissioning the Zwentendorf plant, despite its completion, leading to the definitive halt of the national nuclear program and an estimated loss of over one billion euros (adjusted for inflation).

Since then, Austria has maintained a strong political and societal consensus against civil nuclear power, preferring to invest in renewable energy and energy efficiency. Paradoxically, the country now hosts Europe’s largest nuclear training center, particularly for decommissioning professions, and remains a key player in international safety debates.

Reinventing Europe’s civil nuclear landscape: the rise of Small Modular Reactors

Far from a uniform model, Europe is seeing a diversity of nuclear trajectories emerge. As detailed above, this includes industrial revival, modernization, and even ex nihilo construction. Even historically opposed countries, such as Belgium or Germany, are reassessing their choices in light of new energy challenges.

In this context, Small Modular Reactors (SMRs) are gaining ground in European energy strategies. This more flexible and faster-to-deploy technology makes nuclear power better suited to contemporary challenges. It enables a shift away from centralized, heavy, and costly models toward more targeted and agile uses. Thus, countries without a historical nuclear sector, such as Norway or Poland, can consider gradual integration, while more advanced nations, like Finland or Sweden, see SMRs as solutions to diversify uses toward urban heating and coverage of remote areas.

In summary, SMRs could redefine the role of nuclear power in Europe’s energy mix, integrating more easily into local grids and compensating for the intermittency of renewables. However, Europe currently lags behind North America and Asia. Canada has already launched construction of the first commercial SMR in Darlington, with a standardized model (BWRX-300) designed for serial replication. The United States is betting on the same design, while China has commissioned its first gas-cooled SMR (HTR-PM) and is preparing for industrial scale-up. Nonetheless, Europe is not isolated, benefiting from technological cooperation with its North American partners. This is exemplified by the partnership between Romania and NuScale Power, supported by the United States. This project illustrates a concrete dynamic of international collaboration through shared expertise and the adoption of common standards.

This publication was produced with the help of Bianca REDNIC and Nathan BRIERE. Our thanks also go to Sophie DE MASSOL and François DE TORSIAC.