This first study by Efma, Ecole des Ponts Business School, and Wavestone aims to establish an overview of the financial sector’s considerable scope for action on the corporate social responsibility front.

The major financial players, starting with the sector leaders who are Efma members, play a key role in economic, societal and environmental terms. Taking the initial examples of this, which are covered in this study, we can observe: an increase in the number of initiatives from major players, each having a positive impact on available support for entrepreneurs and SMEs; increasing access to financial services underpinned by assistance and financial-education tools; the financing of infrastructure in emerging countries; and financial initiatives that help protect the environment (green funds, etc.).

Financial institutions are evolving towards more social responsibility

Initiatives that are becoming progressively more profitable

The nature of CSR initiatives is in transformation: banks are progressively moving from charitable donations and pure and simple philanthropy to the creation of specific offerings and services to handle these concerns.

Andrea Lecce

Executive Director of the “Retail and Small Business Sales & Marketing Department” at Intesa Sanpaolo

There is a push on the one hand for the definition of models for measuring environmental risk in portfolios, and on the other hand towards the search for business opportunities in green sectors and counterparts.

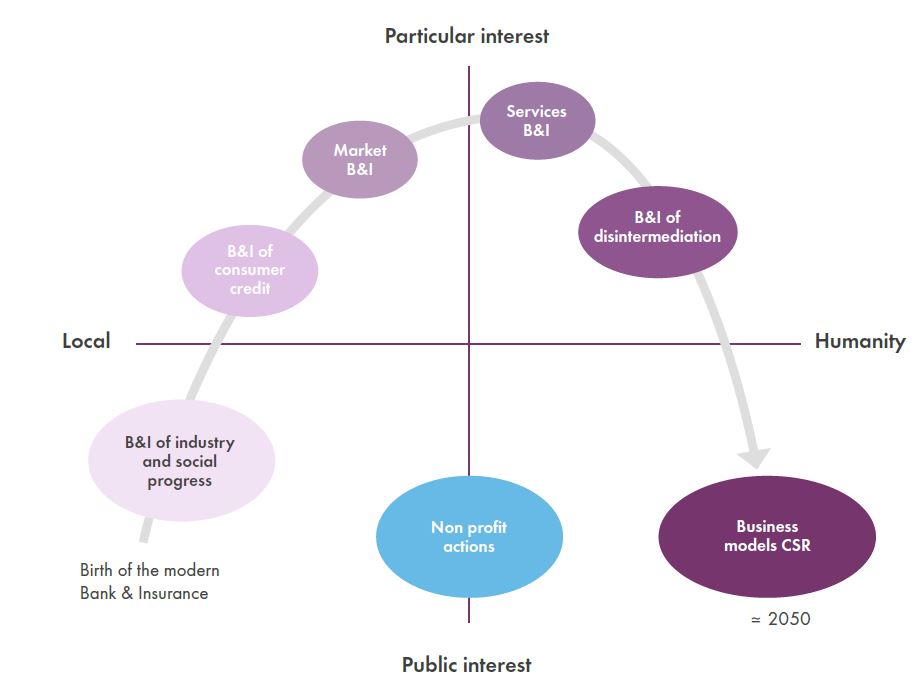

In light of this transformation, banks and insurance companies are becoming reacquainted with their traditional role by accentuating their position with regard to general interest :

*B&I: Bank & Insurance

Efforts that need to be further increased, given the extent of the societal and environmental challenge

The changes proposed by financial institutions are based on an incremental strategy centered around the transformation, or sometimes simplification, of existing offerings and services.

Moreover, the impact of commitments on inclusion and sustainable development remains a marginal one, as set out in work by The European Political Strategy Centre (EPSC).

In its “Financing Sustainability” note, it stresses that less than 1% of global bonds qualify as “green” and less than 1% of the assets held by global institutional investors relate to environmentally friendly infrastructure.

Moving towards the Bank and Insurance Company of the Future

There is a lot of elements coming together to incite serious reflection on what the bank of tomorrow should be.

More than technological responses, it’s new models that need to be established. This does not only involve anticipating the needs of customers and banking institutions; the issue is determining what place banks will occupy in meeting the needs of our societies.

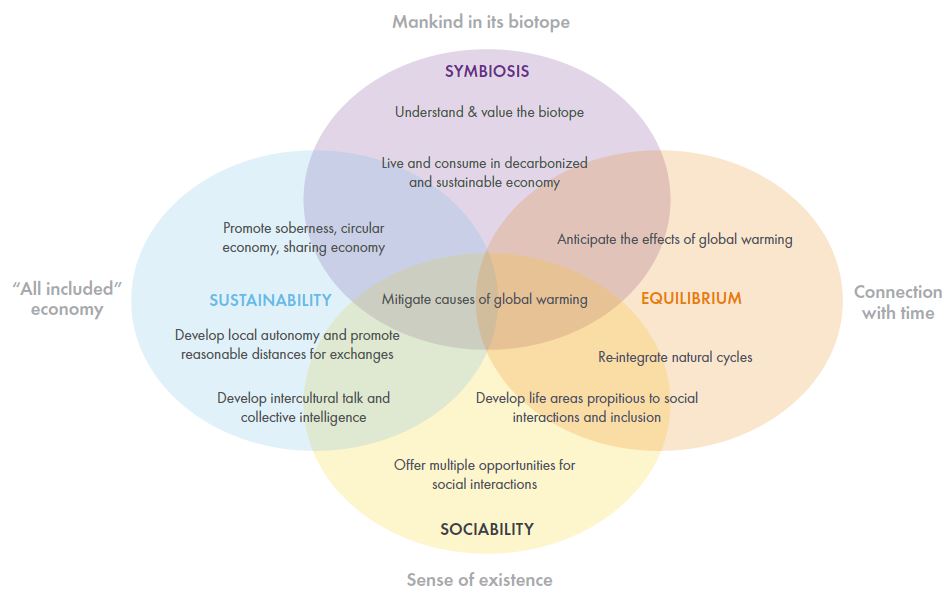

There are five dimensions that seem particularly apt for fostering reflection on new development models for

financial services:

/ Future evolution of the biotope and the human race: in search of symbiosis

/ Shifting society’s ideas: in search of a more balanced relationship in time to involve

as many as possible

/ New technologies: in search of redefining a new utility

/ Contemporary understanding of human nature: rediscovering how to

“live together”

/ The evolution of uses and the definition of value