How to accelerate the ecosystem’s growth?

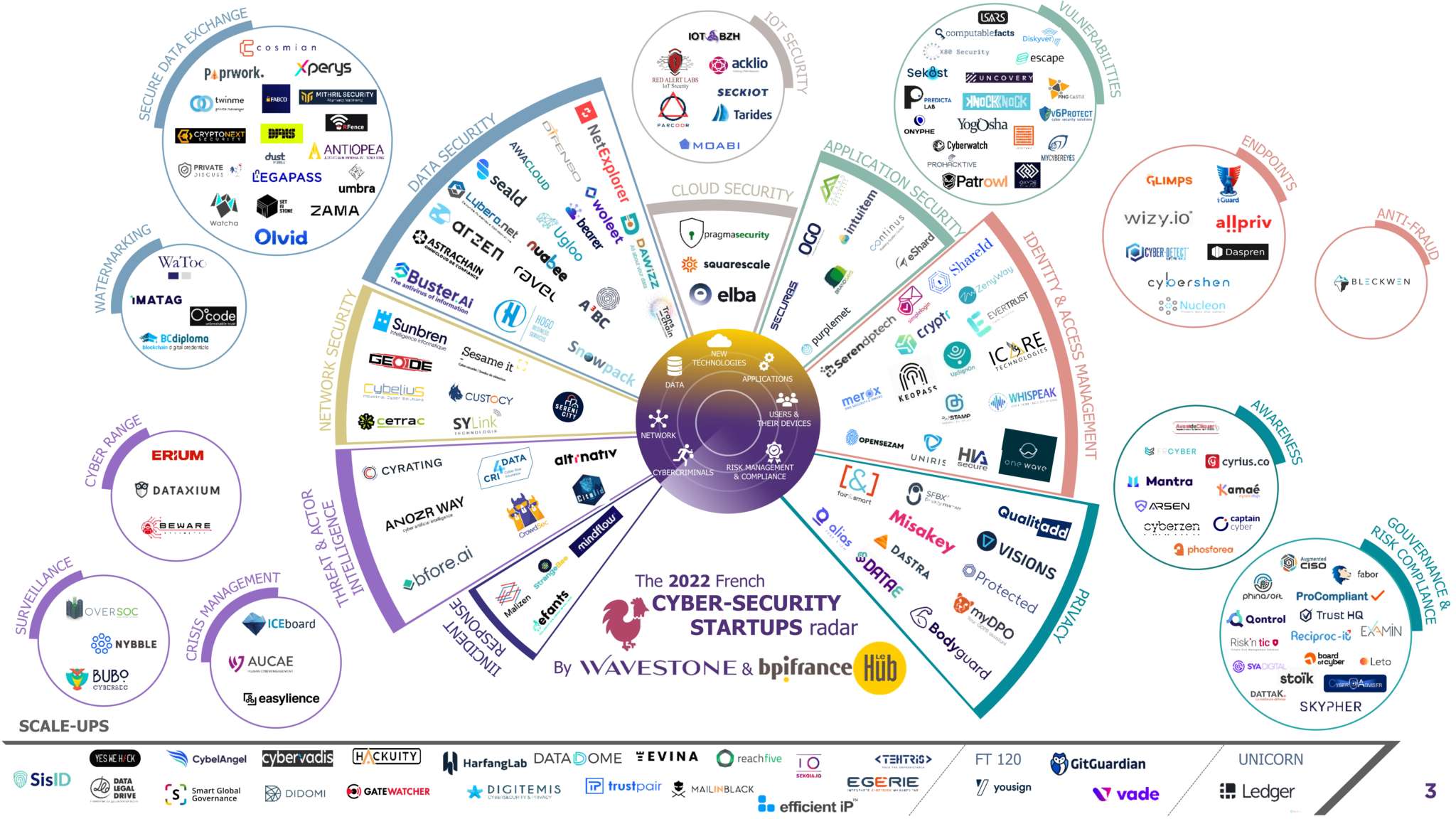

The 2022 edition of the Wavestone French Cybersecurity Start-up Radar comprises 166 start-ups, 24 scale-ups, 1 cyber unicorn. In addition, €630M of funding was raised for start-ups and scale-ups, demonstrating a significant increase in investment compared to last year.

Given the current geopolitical climate, cybersecurity is now more than ever a major strategic issue. The conflict in Ukraine has highlighted our collective need for new cybersecurity champions to guarantee Europe’s sovereignty and strategic independence. As evidenced by some early positive results, the innovation ecosystem appears to be playing a key role in progressing towards this goal. However, there is a strategic imperative to accelerate this progress. Alongside its business partners, Wavestone has identified two major growth levers during this study.

Key takeaways from the radar

- 166 startups in this year’s radar vs. 150 in 2021, a relatively stable number

- 24 cybersecurity scale-ups in France

- The 1st French cybersecurity unicorn: Ledger

- €630M in raised funds

- A large number of French and European initiatives were launched in the last two years to enhance competitiveness with foreign markets

- Leverages to unlock growth for entrepreneurs and the ecosystem

The start-up ecosystem is stable and renews itself…

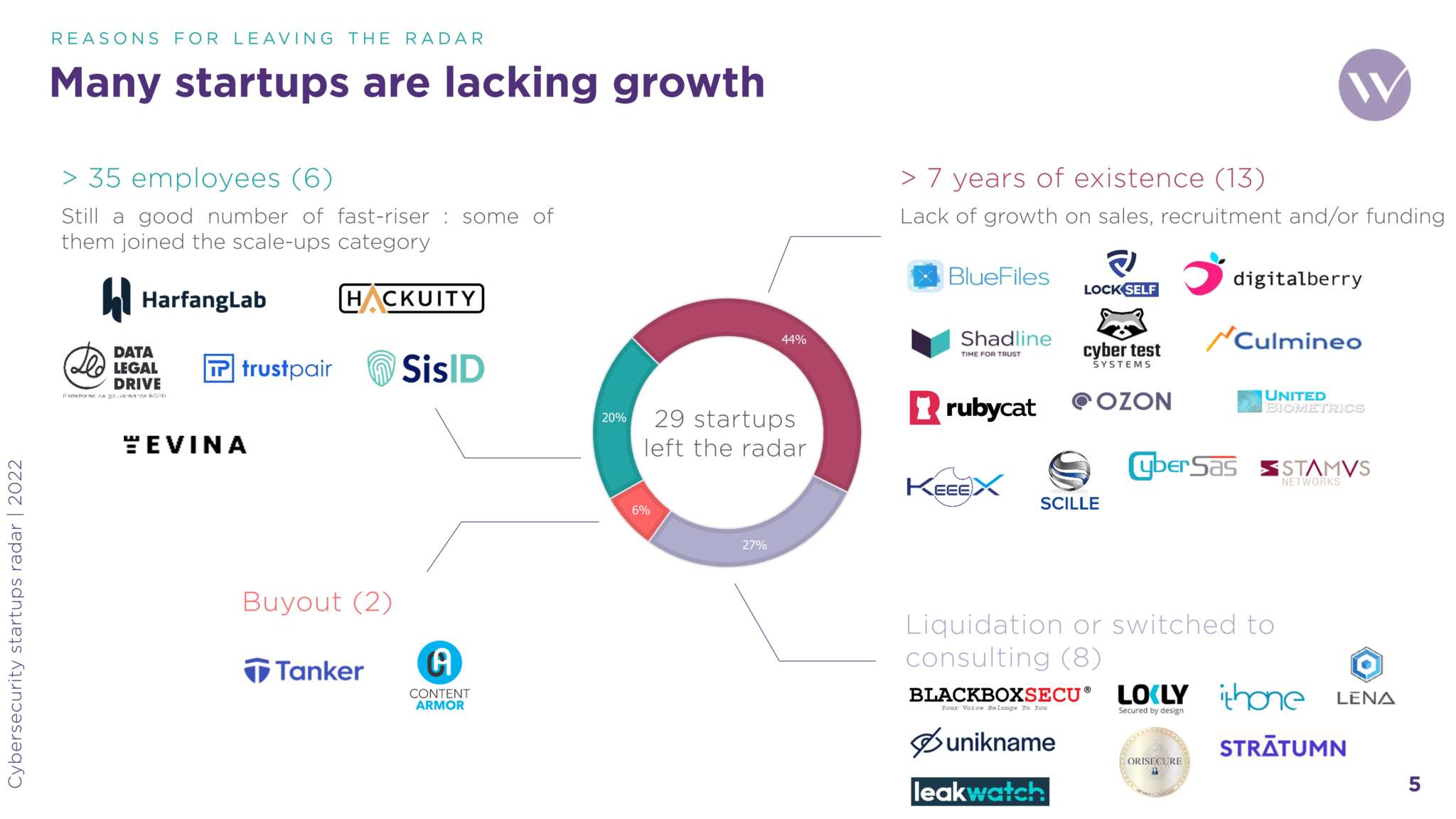

A total of 166 start-ups specialized in cybersecurity were identified in 2022 (150 in 2021). The ecosystem can self-renew dynamically. For example, there have been 45 new start-ups identified since last year’s publication, whereas 13 start-ups exited the market in 2022 as they were unable to scale-up.

…and accelerates the production of scale-ups

The ecosystem is progressively becoming more mature. Over the past year, it has witnessed an increase in scale-ups (11 in 2021 vs 24 in 2022) and remarkably, the first unicorn of the market, Ledger. One considerable acquisition is also worth noting: the purchase of Ubble by the British payment solution’s firm, Checkout.com. This acquisition adds weight to the perceived quality of French cybersecurity firms and the expertise that they can offer.

A weakness in innovation

Of all Cybersecurity start-ups, 61% re-invent existing solutions without bringing noticeable innovations to the table. This could be explained in part by the high number of founders operating in isolation from the research and development environments. For example, of the start-ups that happen to re-invent, only 22% collaborate with research labs and only 16% interact with the private sector. However, tangible developments can be seen, especially surrounding data security and data exchange security, where several start-ups have launched truly innovative solutions.

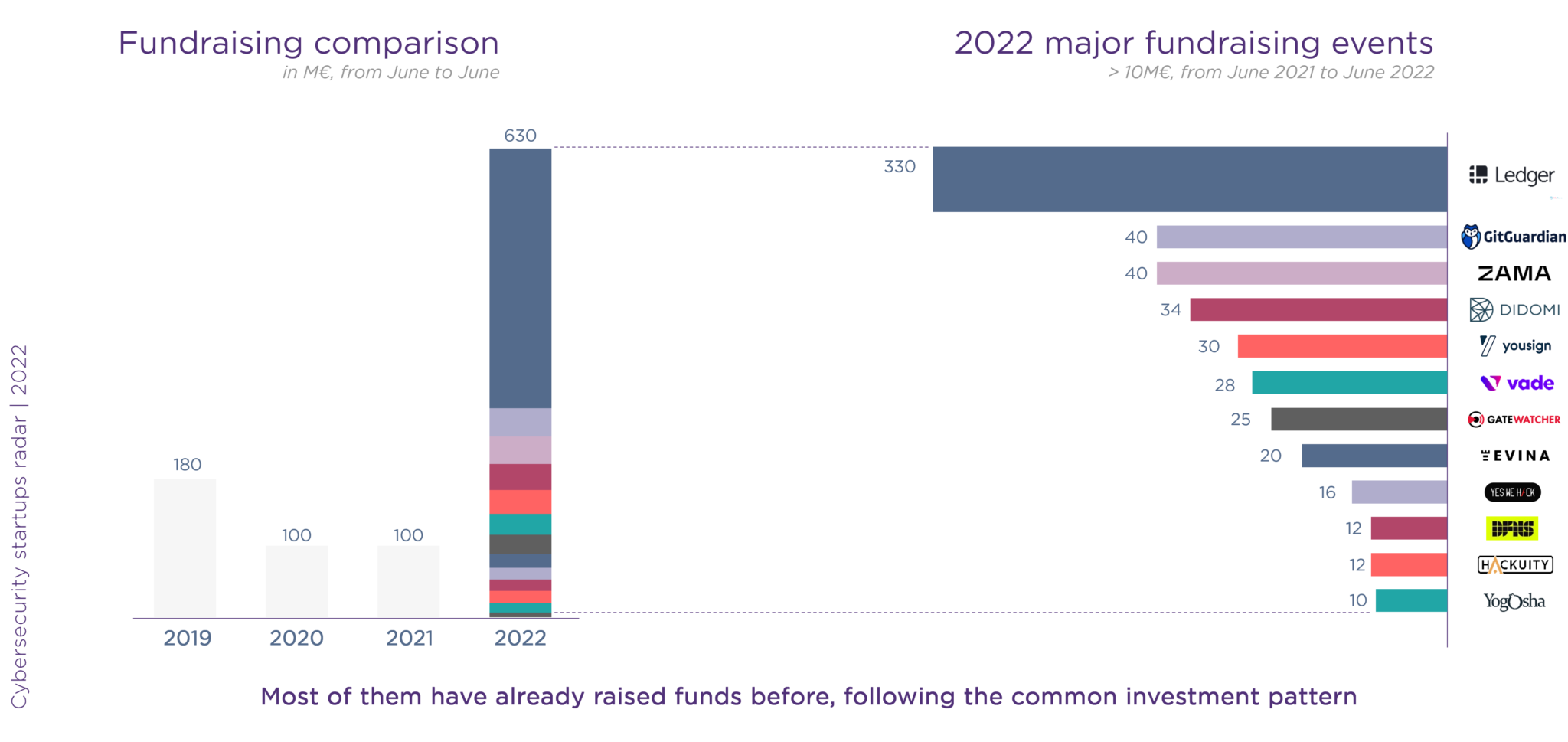

Greater and larger fundraisings

The total amount of funds raised grew six-fold since last year (€100M in 2021 vs. €630M in 2022). Even removing Ledger (€330 million) from the equation, it seems reasonable to suggest that investment in the ecosystem is gaining momentum.

Naturally, France still demonstrates a large potential for improvement; especially when compared to American (about €14B) and Israeli (about €1.6B) champions, and its British neighbours (about €900M).

French and European ecosystems are undergoing significant change

In the last few years, France has launched numerous initiatives to boost the ecosystem as part of the State’s €1bn Recovery Plan. A significant portion of this plan is directly aimed at stimulating innovation (the pan “investment for the future” today integrated in France 2030).

- An undeniable improvement of the ecosystem which has produced successful businesses and entrepreneurs is not only paving the way for newcomers but is also providing them with opportunities to learn and grow through coaching.

- The launch of the Cyber Campus and dedicated measures for start-up support (e.g., the Cyber Booster or the future Cyber Campus’ accelerator). The campus can also host cross-sector and multi-player projects, mixing academics and industry players, and thereby creating an optimal space for discussions, ideas, new innovations.

- The implementation of The Grand Cyber Challenge with the objective of drawing public and private sectors closer to cybersecurity.

- The creation of a cyber observatory, led by the SGPI, which regularly publishes a list of strategic topics and associated contests to boost innovation.

How to further speed up the advent of cyber champions?

To respond, Wavestone has launched a dedicated team comprised of key players of the cyber ecosystem: Bpifrance, France Digital, the General Secretariat for Investments (SGPI) and the Cyber Campus. Furthermore, Wavestone has conducted interviews with innovation ecosystem constituents (investors, public actors, researchers, entrepreneurs, and support structures) to obtain a view of perspectives.

The obstacles are real and have been known for a while. A fragmented European market, difficulties to export internationally, difficulties to innovate, a lack of ambition from business founders, problems linked with human resources (hiring, lack of skills in commercial development, …), apprehensive investors and industry players neglecting adequate funding in cybersecurity and exit difficulties in the cyber sphere.

A portion of the solutions to these obstacles have also been known for a while and several actors (incubators, support structures, …) are already taking action to overcome them. These approaches include fine-tuning value propositions and pitching skills, creating favourable conditions for the adoption of their solution, addressing clients as quickly as possible, and leveraging their start-up appeal to hire top talent. Joining these structures is essential. But joining the most recent ones that specialize in cybersecurity is ideal.

What’s more, our workgroup has identified additional measures to take advantage of the current situation.

- For entrepreneurs: benefit from the recently created ecosystem to rapidly confirm your innovation, be ambitious regarding international expansion (do not hesitate to join international incubators to quickly test your ideas and the foreign markets), and carefully choose your path for growth (depending on the level of innovation of your solutions and the targeted markets, paths are not identical).

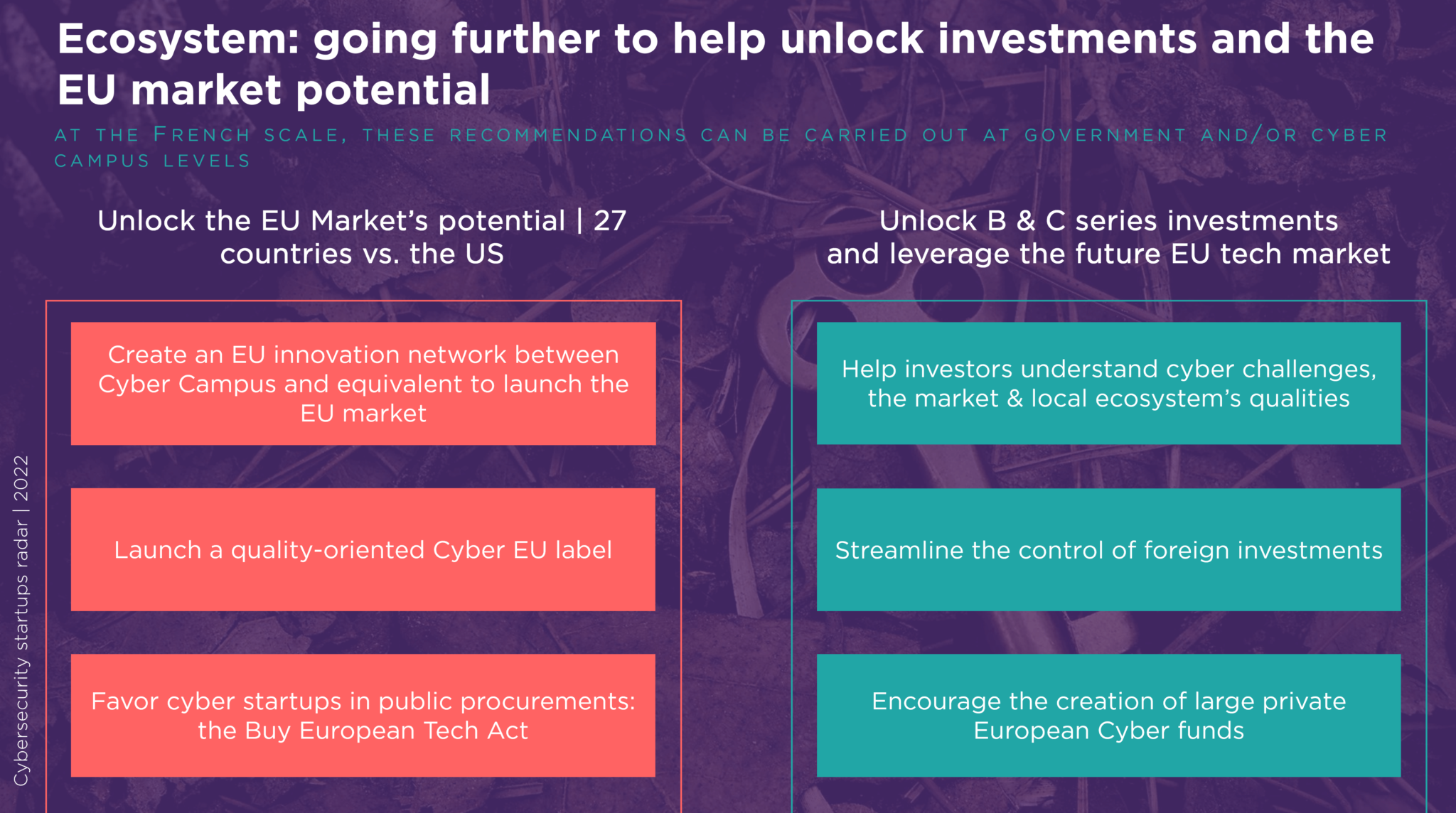

- For the ecosystem: it is urgent to simplify the access to the European market. This is made possible thanks to tangible networking, decoding and labelling the actions carried out by key cybersecurity innovation players. The strengthening in purchase preferences as mentioned in the “Buy European Tech Act” project is also a key driver. Regarding investments, a step up is necessary to challenge the United States and will require better communication with investors, more transparency concerning the exportation and foreign investments control processes, but also incentives for new sizeable European cyber funds.

Every actor taking part in this study (BPI France, France Digitale, Cyber Campus, the General Secretariat for Investments (SGPI) and Wavestone) is currently mobilized to implement these measures, each in their respective field, and to speed up the development of the cybersecurity innovation ecosystem.

Start-up and scale-up selection procedure and criteria

Start-ups and scale-ups must have registered headquarters in France and the sales of their security solution must account for 50% of their turnover.

A Start-up is any firm established less than seven years ago and which has fewer than 35 employees.

Scale-ups need to meet at least one of the following three requirements:

- Received capital for three years owing to at least €10M in raised funds

- Have a turnover between €2.5M and €5M, and a turnover growth rate higher than 50% for the last three financial years

- Have a turnover greater than €5M and an annual turnover growth rate greater than 25% for the last three financial years

No further businesses were added to this edition of the radar after the 1st of June 2022.

This study was based on qualitative interviews with the majority of the start-ups that appear in this radar and actors from the innovation sector.

About Wavestone

In a world where knowing how to drive transformation is the key to success, Wavestone’s mission is to inform and guide large organizations in their most critical transformations, with the ambition of a positive outcome for all stakeholders. This ambition is anchored in the firm’s DNA and summarized in its signature approach –”The Positive Way.” Wavestone draws on over 3,000 employees across 9 countries. It is a leading independent player in European consulting. Wavestone is listed on Euronext Paris and recognized as a Great Place to Work®.

Regarding BPI France

Bpifrance finances businesses in every step of their development with loans, guarantees, and equity. Bpifrance supports them in their innovation projects and internationally. Bpifrance ensures their export activity through a large panel of products. Consulting, university, networking, and acceleration programs designed for startups, SMEs, and intermediate-sized companies, are as well included in the offer for entrepreneurs. Thanks to Bpifrance and its 50 regional establishments, entrepreneurs benefit of a unique near-by correspondent, enabling efficient support through the challenges they might face.

Regarding the Cyber Campus

Launched by the French president, the Cyber Campus is a cybersecurity beacon uniting major national and international actors. It enables hosting on the same premises companies (corporations, SMEs.,.), state-backed services, training organizations, research actors, and associations.

The Cyber Campus leads actions with the objective of uniting the cybersecurity community and developing synergies between its different players. Partnerships between the national and territorial campuses have begun. To date, more than 200 actors coming from diverse activity sectors have committed to the Cyber Campus.

Regarding France Digitale

Founded in 2012, France Digital is the largest startup association in Europe uniting more than 2000 startups and French digital investors. The association has for objective creating European digital champions and stimulating the startup ecosystem in France.

France Digitale is cochaired by Frédéric Mazzella, founder of BlablaCar, and Benoist Grossmann, CEO of Eurazeo Investment Manager.

Regarding France 2030

France 2030 investment plan is reflective of a dual ambition: sustainably transform sectors key to our economy thanks to technological innovation, and position France as not only an actor of tomorrow, but a leader for change.€54B will be invested towards successfully transitioning our businesses, universities, and research organisms to those strategic sectors. Enabling them to competitively answer to upcoming ecological and alluring challenges, and setting forth the future leaders of our sectors of expertise are at stake.