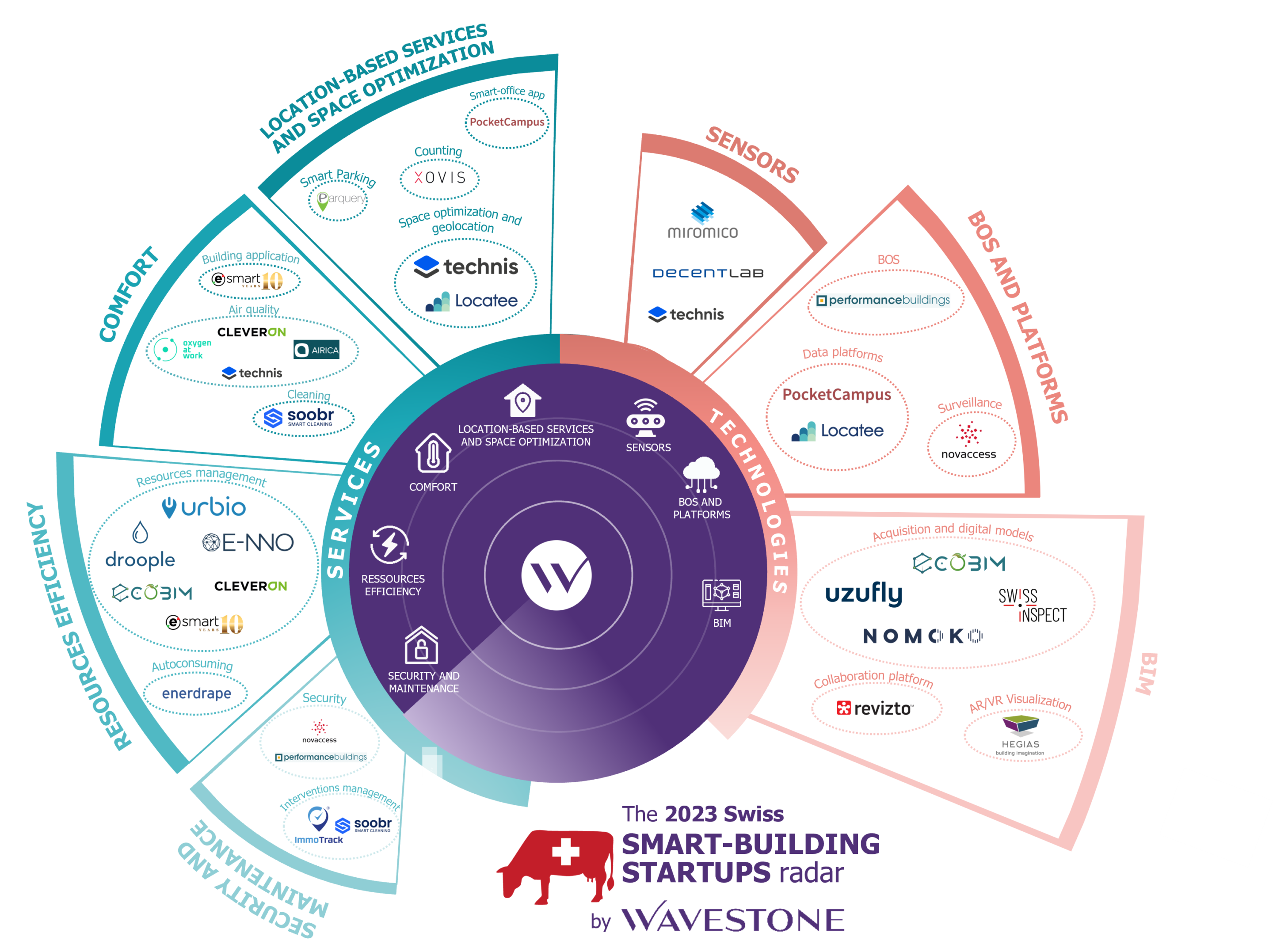

Radar of Smart Building startups in Switzerland: 2023 edition

The Smart Building topic now resonates as a key theme in the sustainable transformation of institutions and companies. To better understand this theme and the challenges that arise from it, Wavestone has been analyzing, since 2019, the major issues addressed by the Smart Building sector through its different radars. This year, Wavestone proposes a focus on the Swiss market and its local characteristics. You will discover innovative and internationally oriented Swiss startups, offering state-of-the-art tools to address a major issue: saving space and resources in a tense economic context.

As energy prices continue to rise across Europe, technologies that improve the way we produce, store, and consume energy will play an important role in energy efficiency in 2023.

The smart building sector – being able to optimize energy consumption, reduce waste and improve overall efficiency through end-to-end smart solutions will have an even greater role to play. With the current unstable economic situation, the smart building industry is poised to become a smart investment source for multinational corporations and property owners.

Unsurprisingly, some studies show that 43% of companies plan to increase investment on data mining. They want to equip themselves with tools to measure their performance more accurately to make informed decisions (source JLL).

In addition, 90% of companies worldwide are planning to reduce their energy consumption by 2025, a predictable figure taking into consideration the context and the fact that the building industry is responsible for up to 40% of greenhouse gas emissions (source JLL).

Forbes’ predictions suggest that the improving energy efficiency trend through technology will only continue. It will further strengthen the position of smart building startups, and quick-to-deploy IoT devices, as an effective and cost-efficient solution for energy consumption in 2023 and beyond.

Key learnings:

- The three main themes of Smart Building in 2023 address the rationalization of space and resource use, the differentiating user experience, and building management

- The Swiss market is composed of independents and internationally oriented startups

- Swiss startups stand out for their strong presence of finished IoT solutions

Key figures

28

Swiss startups

2nd

Real estate is the 2nd largest expense item for a company after payroll

2016

average creation date

21

employees on average

Trend #1: Rationalization of space and resources

One of the main issues that companies in the Smart Building sector are addressing is resources and space rationalization.

These two themes being the main topics of Real Estate Management, it is not surprising that Smart Building startups massively address them.

Space optimization: The economical solution for companies

Real estate is a company’s second largest expense after payroll. Therefore, decision-makers are constantly looking for solutions that can optimize the number of square meters leased without compromising the comfort of its users.

Startups have been created, such as Locatee to only name them, around these topics to give access to building occupancy and usage data to real estate decision-makers. This allows them to make informed decisions about their current properties/rental park and future real estate projects.

Limited resources: Rationalization is essential in 2023

About resource rationalization, the environmental context in which we find ourselves, paired with the recent increase in the price of energy, is pushing companies to equip themselves with consumption control solutions. For a medium-sized company, for example, Bern estimates the increase in energy bills of 24% for the year 2023 alone.

The Smart Building sector largely addresses this issue by optimizing the consumption of water (Droopl’s offer on our radar), electricity, and heating (E-nno’s offer on our radar) based on an analysis of space usage and weather forecasts.

Trend #2: A differentiating user experience

In recent years, the workplace has become a key factor in attracting and retaining talent. In fact, many real estate projects have been realized in the last few years with this parameter in mind.

This is why we have seen projects of relocation within cities to be closer to the places of services for its employees. Campus projects like the giant Google, offering a range of services worthy of a vacation village as well as coworking space with a service closer to a hotel than the simple office.

In addition to real estate projects, the Smart Building sector can contribute to the improvement of the user experience within buildings. For example, applications can help employees organize their workday, provide access to the entire range of building services, or enable all users to find their way around large campuses (PocketCampus). Others will allow controlling the whole building (guest access, door opening, meeting rooms) via a simple mobile application. (Performance Buildings AG).

Trend #3: The Smart Building, a key support in building management

The Facility Management, a key topic

The Smart Building sector also provides an answer to the issues of facility management by equipping them with building management.

These tools can be used to report failures and breakdowns, as well as tools equipped with Machine Learning to perform predictive maintenance by anticipating future failures on equipment.

Facility management is also closely linked to data collected on building usage. Depending on the number of visitors, the facility manager can adapt the level of service required for the maintenance or cleaning of his building (Droople, Technis). Complemented by services such as ImmoTrack, it will be possible to automatically optimize the routes of his teams, even across a large fleet.

The integration of building management tools: Essential?

The first goal of these IoT solutions is to better control the building, and integration with the BMS (Building Management System) will quickly become necessary. If some sensors have modern APIs (Application Programming Interface) making integration possible, their number and the diversity of interfaces offered make the use of a BOS (Building Operation System) almost indispensable.

Other markets have been able to meet this need. Either through the massive development of unified APIs (BOS) capable of communicating with many different software and devices or by providing a wide variety of IoT devices through a single company, to cover a maximum number of needs while offering a unified interface.

The Swiss market remains relatively weak in software solutions and most of the startups presented (with the notable exception of Technis) only provide sensors for a specific need, although these are often more “intelligent” than what the competition offers.

The Swiss ecosystem, startups at the cutting edge of technology

The Swiss market at the forefront of IoT technologies, but still fragmented

The Swiss market is characterized by a strong presence of finished IoT solutions: dedicated hardware alongside Machine Learning algorithms, often resulting from several years of university research. Generally, the user will be able to analyze the collected information and interact with the tools through a dedicated SaaS platform. While this process makes installation and uses quick and intuitive, it has one major drawback: integration. In the case of a large building with multiple sensors (water consumption, air quality, etc.), the Facility Manager will find himself with many disparate platforms, little centralized information, and almost no communication between solutions.

Independent startups relying on the research sector

In large markets, many startups emerge as spin-offs of large private construction or building management groups, with a particular interest in their scope of activity. The Swiss situation is different: the majority of startups observed are based on university research, where our two polytechnics schools play a crucial role (EPFL & ETHZ).

Innovation through public research and then the creation of a startup is a privileged way of technology transfer and is widely supported by both public and private organizations such as Innosuisse, VentureKick, or SwissPropTech.

Startups with fast international expansion

Switzerland is by nature a small and fragmented market, with 4 national languages and 8 million inhabitants. Thanks to its strong university system and the massive presence of investments in startups ($316/capita, compared to $178/capita for France), Switzerland is an excellent incubator for innovative solutions but is very quick to push its companies to expand internationally.

Startups on the Swiss radar, even if they have national customers and started in Switzerland, will quickly try to conquer international markets – long before they have left the incubator or stabilized their position in their national market. Because of the geographical and cultural proximity, this expansion is often done towards France or Germany, in the first phase. The most advanced ones will then move towards the American market, given its large volume, supported by public organizations such as SwissNex which provide networks and opportunities.

Conclusion

Thanks to space and resource-saving opportunities in a tight economic context, the Smart Building market is growing rapidly every year.

The Swiss startups presented on this radar will play an important role, being able to quickly transform the results of long university research into finished products, ready to optimize our buildings on an international scale. To be fully effective, these solutions will have to be able to communicate not only with each other but also with the building’s pre-existing infrastructure: thus, any large-scale project requires a prior strategic reflection on the creation of this ecosystem.

Methodology

The Wavestone radar of Smart Building startups in Switzerland identifies the emerging players of the Swiss ecosystem in terms of Smart Building innovation.

- Head office in Switzerland

- Less than 100 employees

- Less than 10 years of activity (founded after 2012)

- Smart Building product, software, or hardware

- Consolidation of information with incubators and Prop Tech associations

- Evaluation regarding the mentioned criteria

- Qualitative interviews with startups